Used Vehicle Sales Tax In Illinois . The tax rate is based on the purchase price. you have to pay a use tax when you purchase a car in a private sale in illinois. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. For example, if you buy a used car. There is also between a 0.25% and 0.75% when it comes. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party.

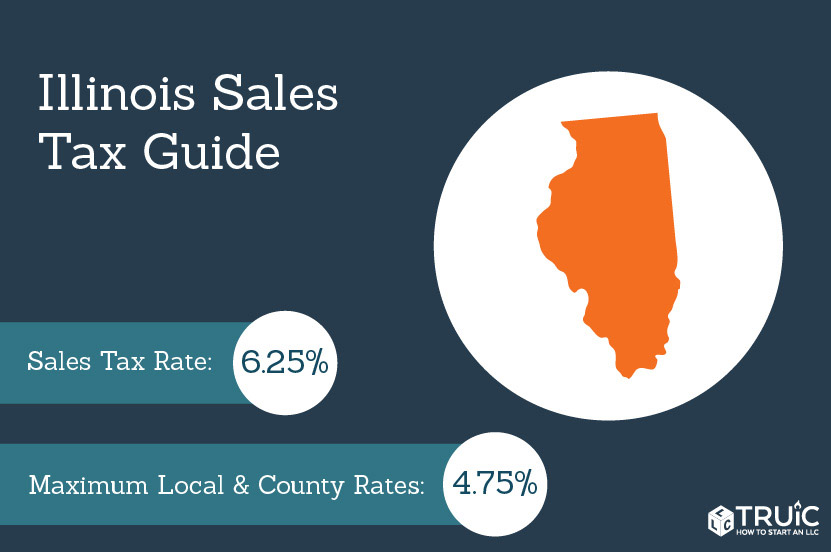

from howtostartanllc.com

the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. The tax rate is based on the purchase price. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. There is also between a 0.25% and 0.75% when it comes. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. For example, if you buy a used car. you have to pay a use tax when you purchase a car in a private sale in illinois.

Illinois Sales Tax Small Business Guide TRUiC

Used Vehicle Sales Tax In Illinois the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. There is also between a 0.25% and 0.75% when it comes. The tax rate is based on the purchase price. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. For example, if you buy a used car. you have to pay a use tax when you purchase a car in a private sale in illinois. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car.

From pannaindywidualna.blogspot.com

Illinois Used Car Sales Tax 2020 Gas Tax Rates By State 2020 State Used Vehicle Sales Tax In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. For example, if you buy a used car. you have to pay a use tax when you purchase. Used Vehicle Sales Tax In Illinois.

From cezrodos.blob.core.windows.net

Car Sales Tax Illinois Cook County at Christy Calvin blog Used Vehicle Sales Tax In Illinois the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. For example, if you buy a used car. illinois private party vehicle. Used Vehicle Sales Tax In Illinois.

From www.carsalerental.com

What Is Illinois Sales Tax On A Car Car Sale and Rentals Used Vehicle Sales Tax In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois collects a 7.25% state sales tax rate on the purchase of. Used Vehicle Sales Tax In Illinois.

From dxolsfeet.blob.core.windows.net

Vehicle Sales Tax Il at Joshua Smith blog Used Vehicle Sales Tax In Illinois For example, if you buy a used car. The tax rate is based on the purchase price. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. illinois private party vehicle use tax is based on the purchase price (or fair market value). Used Vehicle Sales Tax In Illinois.

From exozhhwmx.blob.core.windows.net

Used Car Illinois Sales Tax at Terry Shuler blog Used Vehicle Sales Tax In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. For example, if you buy a used car. The tax rate is based on the purchase price. illinois private party vehicle use tax is based on the purchase price (or fair market value). Used Vehicle Sales Tax In Illinois.

From www.carsalerental.com

Buying A Car Out Of State Taxes Illinois Car Sale and Rentals Used Vehicle Sales Tax In Illinois the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. For example, if you buy a used car. The tax rate is based. Used Vehicle Sales Tax In Illinois.

From www.caranddriver.com

What Is Illinois Car Sales Tax? Used Vehicle Sales Tax In Illinois the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the. Used Vehicle Sales Tax In Illinois.

From ceapwkgf.blob.core.windows.net

Car Purchase Sales Tax Illinois at Sidney Loya blog Used Vehicle Sales Tax In Illinois the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. you have to pay a use tax when you purchase a car in a private sale in illinois. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party.. Used Vehicle Sales Tax In Illinois.

From madelenawjeane.pages.dev

Mass Sales Tax Rate 2024 Eudora Malinda Used Vehicle Sales Tax In Illinois The tax rate is based on the purchase price. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Used Vehicle Sales Tax In Illinois.

From natashaglover.z13.web.core.windows.net

Illinois Used Car Sales Tax Chart Used Vehicle Sales Tax In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. you have to pay a use tax. Used Vehicle Sales Tax In Illinois.

From www.carsalerental.com

What Is Illinois Sales Tax On A Car Car Sale and Rentals Used Vehicle Sales Tax In Illinois There is also between a 0.25% and 0.75% when it comes. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. The tax rate is based on the purchase price. illinois collects a 7.25% state sales tax rate on the purchase of all. Used Vehicle Sales Tax In Illinois.

From pannaindywidualna.blogspot.com

Illinois Used Car Sales Tax 2020 Gas Tax Rates By State 2020 State Used Vehicle Sales Tax In Illinois the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the. Used Vehicle Sales Tax In Illinois.

From metrovoicenews.com

Democratrun Illinois to impose car tax on tradeins Metro Voice News Used Vehicle Sales Tax In Illinois you have to pay a use tax when you purchase a car in a private sale in illinois. the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car.. Used Vehicle Sales Tax In Illinois.

From netla.hi.is

Illinois Sales Tax On Used Cars Calculator Cheap Sale netla.hi.is Used Vehicle Sales Tax In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. you have to pay a use tax when you purchase a car in a private sale in illinois. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the. Used Vehicle Sales Tax In Illinois.

From cezrodos.blob.core.windows.net

Car Sales Tax Illinois Cook County at Christy Calvin blog Used Vehicle Sales Tax In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois private party vehicle use tax is based on the purchase price (or. Used Vehicle Sales Tax In Illinois.

From patch.com

Illinois To Start Collecting Sales Tax On Vehicle TradeIns Worth More Used Vehicle Sales Tax In Illinois illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. you have to pay a use tax when you purchase a car in a private sale in illinois.. Used Vehicle Sales Tax In Illinois.

From www.carsalerental.com

How Much Is Sales Tax In Illinois On Used Cars Car Sale and Rentals Used Vehicle Sales Tax In Illinois the statewide sales tax on vehicles in illinois currently stands at 6.25% of the purchase price of the car. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. you have to pay a use tax when you purchase a car in. Used Vehicle Sales Tax In Illinois.

From www.formsbank.com

Fillable Rut25X, Amended Vehicle Use Tax Transaction Return Used Vehicle Sales Tax In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on the. The tax rate is based on the purchase price. you have to pay a use tax when you purchase a car in a private sale in illinois. the statewide sales tax on. Used Vehicle Sales Tax In Illinois.